Understanding SBI Monthly Interest: A Comprehensive Guide

Introduction

When managing finances, understanding the concept of SBI monthly interest can help you make informed decisions about savings and investments. In this guide, we’ll explore how to calculate interest, the tools you can use, and the latest interest rates offered by SBI.

What is SBI Monthly Interest?

SBI monthly interest refers to the interest you earn on your savings, fixed deposits, or other financial instruments provided by the State Bank of India (SBI). By choosing an option where interest is calculated and paid monthly, you can enjoy a steady flow of income, making it an attractive choice for retirees and others looking for regular returns.

SBI Interest Calculator

The SBI interest calculator is an online tool designed to help you calculate your earnings easily. By entering details such as the deposit amount, tenure, and interest rate, you can quickly see how much interest you will earn.

How to Use the SBI Interest Calculator:

- Visit SBI’s official website or trusted financial platforms.

- Select the type of deposit: savings, fixed deposit, or recurring deposit.

- Enter the principal amount, tenure, and applicable interest rate.

- Choose the frequency of interest payment (monthly, quarterly, or annually).

- Click on “Calculate” to get an instant estimate of your returns.

SBI Interest Rates Calculator

Similar to the interest calculator, the SBI interest rates calculator helps you understand how varying interest rates impact your earnings. This tool is particularly useful when comparing different deposit schemes or exploring the benefits of a fixed deposit.

Key Features:

- Real-time rate updates.

- Customized results based on tenure and deposit amount.

- Comparison of monthly and cumulative interest payments.

SBI Interest Rates Today

As of today, SBI offers competitive interest rates across various deposit schemes. Here are some highlights:

Savings Accounts:

- Interest Rate: 2.70% per annum (varies with balance).

Fixed Deposits (FDs):

- Short-term (7 days to 45 days): 3.00% per annum.

- Medium-term (1 year to less than 3 years): 6.50% per annum.

- Long-term (5 years and above): 6.75% per annum.

Recurring Deposits (RDs):

- Interest rates aligned with fixed deposit rates for the respective tenure.

Benefits of Choosing SBI Monthly Interest

- Regular Income: Ideal for retirees or anyone seeking consistent returns.

- Flexible Tenures: Choose from various tenures to match your financial goals.

- Reliable Returns: Backed by one of India’s most trusted banks.

SBI Monthly Interest for Different Deposit Schemes

Savings Account:

- SBI offers monthly interest payouts on select savings accounts.

- Ideal for individuals who prefer liquidity along with modest interest earnings.

Fixed Deposits:

- Monthly payout option is available for fixed deposits.

- You can calculate your expected returns using the SBI interest calculator or the SBI interest rates calculator.

Recurring Deposits:

- Regular monthly deposits ensure disciplined savings while earning competitive returns.

- Great for achieving short-term financial goals.

Frequently Asked Questions

1. How is SBI monthly interest calculated?

SBI calculates monthly interest based on the principal amount, applicable interest rate, and tenure. You can use the SBI interest calculator for an accurate estimate.

2. Are SBI interest rates today different for senior citizens?

Yes, SBI offers higher interest rates for senior citizens on fixed and recurring deposits. Check the SBI interest rates calculator for updated rates.

3. Can I change my interest payout frequency?

Most fixed deposit schemes allow you to choose between monthly, quarterly, or annual interest payouts at the time of account opening. Modifications post-account opening may not be possible.

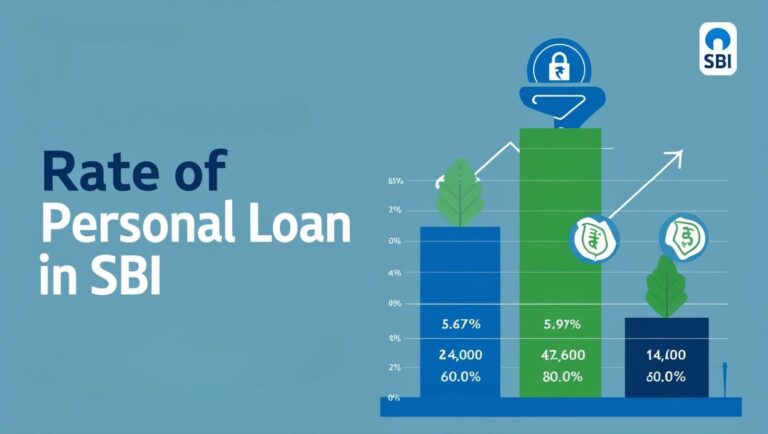

Learn more about loans and its rate of interest in our Your Guide to Personal Loan Interest Rates and Lowest Rates Blog

Conclusion

Understanding SBI monthly interest and using tools like the SBI interest calculator or SBI interest rates calculator can simplify your financial planning. With competitive SBI interest rates today, there’s no better time to explore their deposit schemes and make the most of your money.