Interest Free Loan India: Smart Borrowing Made Simple

Introduction

Imagine dealing with an unexpected cost, like a medical emergency or urgent travel. You realize your savings can’t cover it. For many young professionals, borrowing money feels like a daunting option due to high-interest rates.

But what if you could borrow money without paying interest? Interest-free loans in India, or zero interest loans, can be a big help. They allow you to meet short-term needs without worrying about interest charges.This guide will help you understand these loans, how they work, their benefits, and how to make the most of them.

If you are a young professional, this post is for you. It will help you plan for unexpected expenses. It will also provide smart borrowing options.

Understanding Zero Interest Loans in India

Zero interest loans, as the name suggests, are loans where the borrower does not pay any interest on the principal amount. Unlike traditional loans, where interest accumulates over time, these loans allow you to repay only the borrowed sum.

Key options include:

- Interest-free personal loans offered by banks or fintech firms.

- Zero-interest credit cards with interest-free periods.

- Retailer zero-interest EMI schemes on gadgets or appliances.

It is important to understand terms like principal amount, timely repayments, and minimum credit score. These terms affect your eligibility and repayment process.

Why Zero Interest Loans are Popular Among Young Professionals

For young professionals, zero interest loans are an attractive solution for managing finances affordably. Here’s why:

- No burden of interest: Borrowing becomes more cost-effective, especially for short-term expenses.

- Flexibility for varied needs: From medical bills and education to travel and gadgets, no-interest loans cater to diverse financial requirements.

- Convenient repayment options: Many schemes offer manageable installments, ensuring affordability.

For example, employers often give zero-interest salary advances. Credit card companies may also offer no-interest EMI options for purchases.

Loan Options Without Interest in India

If you’re considering a loan without interest, here are some popular options:

- Zero-interest personal loans: Often provided by employers or fintech companies for specific needs.

- Promotional bank schemes: Banks occasionally roll out zero-interest loan schemes for new customers or special purposes.

- Interest-free credit cards: These allow purchases with an interest-free repayment period (usually 30-50 days). Timely payments are critical to avoid penalties.

- Retailer EMI offers: Many online and offline retailers partner with financial institutions to offer zero-interest EMI plans on products like electronics or furniture.

Remember, while these loans don’t charge interest, some may include processing fees or other charges, so read the fine print.

Eligibility Criteria for Zero Interest Loans

To qualify for a zero-interest loan in India, you’ll typically need to meet these requirements:

- Minimum credit score: A healthy credit score (650+) improves your chances.

- Stable income: Lenders prefer applicants with a regular income to ensure repayment capability.

- Low credit utilization: Keeping your credit card usage under 30% of the limit enhances eligibility.

Young professionals can increase their chances by maintaining good financial habits, such as paying bills on time and avoiding excessive debt.

Tips for Choosing the Best Interest-Free Loan

When selecting a zero-interest loan, consider the following:

- Compare features: Look at repayment tenure, hidden fees, and flexibility.

- Evaluate repayment capacity: Borrow only what you can comfortably repay.

- Understand terms and conditions: Watch for penalties on missed payments and ensure no hidden costs.

For example, if you opt for a zero-interest EMI scheme, confirm whether the retailer or lender charges any upfront fees.

Potential Risks and How to Avoid Them

While zero-interest loans are attractive, they come with potential pitfalls:

- High penalties for late payments: Missed deadlines can lead to hefty charges.

- Processing fees: Some loans may charge fees despite the zero-interest tag.

To mitigate these risks:

- Set up automatic payments to avoid missing due dates.

- Budget wisely to ensure repayments fit into your monthly finances.

Benefits of No-Interest Loans for Young Professionals

Zero-interest loans offer several advantages:

- Affordability: No interest means lower costs overall.

- Financial flexibility: Access funds without disrupting your budget.

- Improved financial wellness: Borrow smartly and repay on time to maintain a healthy credit profile.

These loans are especially helpful for managing short-term financial needs without falling into a debt trap caused by high-interest borrowing.

Conclusion

Zero interest loans in India empower young professionals to manage their financial needs smartly and affordably. By understanding eligibility criteria, comparing loan options, and planning for timely repayments, you can make the most of these opportunities.

Ready to explore interest-free loans? Start comparing options today and take control of your financial goals. To get started, explore our loan calculators and expert resources for more guidance.

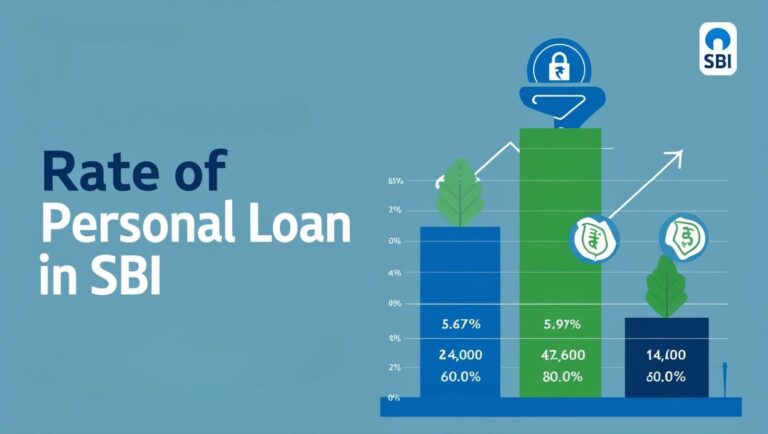

Learn more about loans and its rate of interest in our Your Guide to Personal Loan Interest Rates and Lowest Rates Blog

FAQs About Interest Free Loans in India

1. What is an interest-free loan?

An interest-free loan is a type of loan where the borrower repays only the principal amount without any additional interest charges. These are often offered as promotional schemes by banks, fintech companies, or retailers.

2. How can I get an interest-free loan in India?

You can apply for interest-free loans through:

- Credit cards with interest-free periods.

- Employer-sponsored loan programs.

- Fintech apps offering zero-interest personal loans.

- Retailers providing zero-interest EMI schemes for products.

3. What are the eligibility criteria for zero interest loans?

To qualify, you typically need:

- A minimum credit score (usually 650 or above).

- A stable income source.

- A good credit repayment history.

4. Are there any hidden costs with interest-free loans?

While interest-free loans don’t charge interest, some may include:

- Processing fees.

- Penalties for late payments.

- Administrative charges.

Always read the terms and conditions before applying.

5. Can I use a zero-interest loan for any purpose?

The usage depends on the loan type. Personal loans often allow flexibility, while retailer EMI schemes are typically tied to specific purchases, like gadgets or appliances.