How to activate online transaction in SBI Debit Card

In today’s digital world, online transactions are a primary mode of payment for many individuals. From online shopping to bill payments, the convenience of using your SBI debit card for online purchases is unmatched. However, before you can start making online transactions, you need to activate your SBI debit card for online transaction capabilities. In this guide, we will walk you through every step required to enable and activate online transactions in your SBI debit card. We’ll also cover common FAQs and tips to ensure the process is as smooth as possible.

Why Activate Online Transactions in Your SBI Debit Card?

The SBI debit card is one of the most widely used debit cards in India. It’s not just a card for withdrawing cash from ATMs but also a powerful tool for making online transactions. Activating online transactions on your SBI debit card enables you to:

- Make online purchases: From shopping to digital services, activating online transactions unlocks a wide range of e-commerce options.

- Bill payments: Pay your electricity bills, mobile bills, and other utilities effortlessly.

- Fund transfers: Transfer funds directly to other accounts and make payments via various apps.

- Access to digital services: Use your card for subscriptions, memberships, and other digital services.

However, for security reasons, SBI ATM card activation online is not automatic. You must enable it before using it for online transactions.

How to Activate SBI Debit Card for Online Transaction

There are several ways to activate your SBI debit card for online transactions. You can activate your card for online purchases via SBI’s official website, SBI mobile banking app, or SBI’s ATM. Let’s walk through each method step by step

1. Activating Online Transactions via SBI Online Banking

The first and easiest way to enable ecom activation in SBI is by using SBI’s online banking platform. Follow the steps below:

Step 1: Log In to Your SBI Online Account

- Visit SBI’s official website.

- Enter your username and password to log in to your SBI internet banking account.

Step 2: Go to “ATM Card Services”

- Once logged in, locate the “ATM Card Services” section from the dashboard.

- Click on the “Manage Debit Card” option.

Step 3: Enable E-commerce (Ecom) Activation

- You will be directed to a page where you can manage various debit card settings.

- Look for the option titled “Enable Ecom Transactions” or “Enable Online Transactions”.

- Select your debit card and choose to activate online transactions.

Step 4: Confirm the Action

- After selecting the option, you may need to verify the transaction with an OTP (One-Time Password) sent to your registered mobile number.

- Once the OTP is verified, your SBI debit card will be activated for online transactions.

Step 5: Successful Activation

- You will receive a confirmation message once your ecom activation is successful. Your card will now be ready for online purchases.

2. Activating Online Transactions via SBI YONO App

If you prefer using your smartphone for managing banking transactions, the SBI YONO app is an excellent tool. Here’s how you can activate your SBI debit card for online transactions through the app:

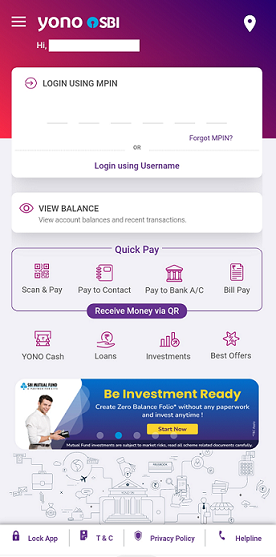

Step 1: Download the SBI YONO App

- Download the SBI YONO app from the Google Play Store or Apple App Store and log in using MPIN.

Step 2: Log In to Your Account

- Open the app and log in using your SBI internet banking credentials.

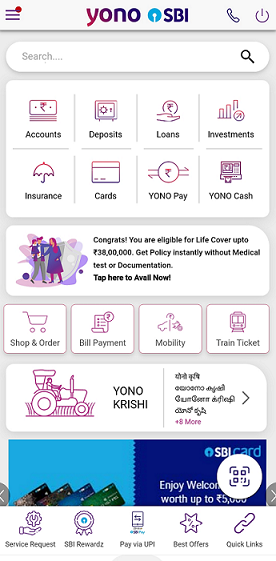

Step 3: Navigate to “Services”

- From the homepage, select “Services” from the bottom menu.

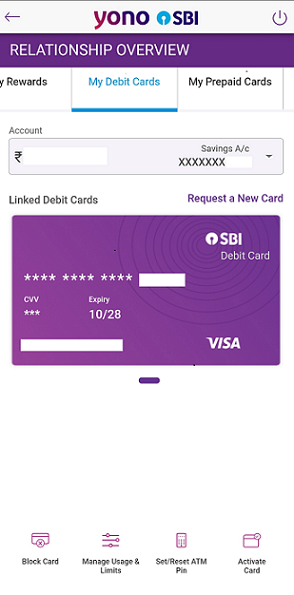

- Next, click on the “Debit Card Services” option.

Step 4: Enable E-commerce Transactions

- From the list of available services, select “Enable E-commerce” or “Activate Online Transactions”.

- Follow the prompts and enter your PIN or OTP for verification.

Step 5: Confirmation

- After the process is complete, you will receive a notification confirming that your card has been successfully activated for online transactions.

3. Activating Online Transactions Using SBI ATM

If you prefer activating your SBI debit card for online transactions via an ATM, follow these steps:

Step 1: Visit Your Nearest SBI ATM

- Insert your SBI debit card into any SBI ATM.

Step 2: Enter Your PIN

- Type in your ATM PIN to access the services.

Step 3: Access Card Settings

- From the ATM menu, select the option for “Services” or “Manage Debit Card”.

Step 4: Activate E-commerce Transactions

- Locate and select “Activate E-commerce” or “Enable Online Transactions”.

- Follow the on-screen instructions to enable online transactions.

Step 5: Confirmation

- The ATM will confirm your request and activate your SBI debit card for online transactions.

How to Disable Online Transactions on Your SBI Debit Card

There may be times when you wish to temporarily or permanently disable online transactions on your SBI debit card. Here’s how you can do that:

Step 1: Log In to Your SBI Online Banking Account

- Visit SBI’s online banking portal.

- Log in with your username and password.

Step 2: Manage Debit Card Settings

- Go to the “ATM Card Services” section.

- Select “Manage Debit Card” and choose the option to disable e-commerce transactions.

Step 3: Confirm the Action

- You may need to verify your request with an OTP sent to your registered mobile number.

- Once confirmed, your debit card will no longer be activated for online transactions.

SBI Debit Card Online Transaction Limit

When you activate your SBI debit card for online transactions, there is usually a transaction limit to consider. This limit may vary depending on your card type, but here are some common limits for online transactions:

- SBI Classic Debit Card: ₹10,000 per day for online transactions.

- SBI Gold Debit Card: ₹25,000 per day.

- SBI Platinum Debit Card: ₹50,000 per day.

To increase your online transaction limit, you may need to contact SBI customer service or visit your nearest branch for assistance.

Security Measures for Online Transactions on SBI Debit Card

When you enable online transactions in your SBI debit card, security should be a top priority. Here are a few tips to keep your transactions safe:

- Use Secure Websites: Always ensure that the websites where you make online transactions are secure. Look for “HTTPS” and a padlock icon in the address bar.

- Activate OTP: Enabling OTP (One-Time Password) verification for every online transaction can add an extra layer of security.

- Use Virtual Debit Cards: SBI offers virtual debit cards for online transactions, which are more secure for online purchases as they can be limited to specific transactions.

- Monitor Your Account: Regularly check your transaction history and account balance to detect any unauthorized activity.

Learn more about Finance in our Mastering Financial Knowledge for a Secure Future Blog

Frequently Asked Questions (FAQs)

1. How to activate online transaction in SBI debit card?

To activate online transactions in your SBI debit card, you can either use SBI’s internet banking portal, the YONO app, or an SBI ATM to enable the ecom activation.

2. What is ecom activation SBI?

Ecom activation in SBI allows you to enable your debit card for online purchases, such as shopping, bill payments, and fund transfers.

3. How to activate debit card for online transaction SBI?

You can activate your SBI debit card for online transactions through SBI online banking, SBI YONO app, or an SBI ATM by selecting the “Enable Online Transactions” option.

4. Can I disable online transactions on my SBI debit card?

Yes, you can disable online transactions on your SBI debit card by following the same method you used for activation, either through online banking, the YONO app, or an SBI ATM.

5. How do I know if my SBI debit card is activated for online transactions?

Once your SBI debit card is activated for online transactions, you will receive a confirmation message from SBI, and your card will be eligible for online purchases.